Comments to CMS on its CY 2023 Proposed Skilled Nursing Facility PPS

June 10, 2022

The Honorable Chiquita Brooks-LaSure

Administrator

Centers for Medicare & Medicaid Services

Submitted electronically

Re: Medicare Program; Prospective Payment System and Consolidated Billing for Skilled Nursing Facilities; Updates to the Quality Reporting Program and Value-Based Purchasing Program for Federal Fiscal Year 2023; Request for Information on Revising the Requirements for Long-Term Care Facilities To Establish Mandatory Minimum Staffing Levels.

Dear Administrator Brooks-LaSure:

On behalf of our nearly 5,000 member hospitals, health systems and other health care organizations, including approximately 700 skilled-nursing facilities (SNF), and our clinician partners — more than 270,000 affiliated physicians, two million nurses and other caregivers — and the 43,000 health care leaders who belong to our professional membership groups, the American Hospital Association (AHA) appreciates the opportunity to address the FY 2023 SNF prospective payment system (PPS) proposed rule.

Proposed FY 2023 Payment Update Warrants Closer Examination

For FY 2023, CMS is proposing a net decrease in SNF PPS payments of 0.9% ($320 million), relative to FY 2022, which includes a 2.8% market-basket update, the statutorily-mandated cut of 0.4 percentage points for productivity, a significant cut related to the FY 2020 implementation of the current case-mix system, and other provisions. Among these changes, we note that the proposed SNF PPS labor-related share would only modestly shift upward from 70.4% in FY 2022 to 70.7% in FY 2023, relative the current cost pressures on the field, as discussed below.

The timing of this proposed net decrease in payments could not be worse, given the well-documented impact of the COVID-19 public emergency (PHE) on the SNF and nursing home field. In many ways, hospital-based (HB) SNFs experienced the PHE differently than their freestanding counterparts because of linkages to their host hospitals. This enabled them to have more robust infection controls, easier access to personal protective equipment and other factors that affected their overall PHE response. That said, HB SNFs and their host hospitals also faced immense challenges with each surge of the pandemic and its after-effects, including supply chain, workforce and over-crowding crises. As such, our HB SNF members are in full agreement with the broader hospital field over the inappropriateness of reducing payments to this critically important part of the continuum of care during a PHE. Rather than reduce payments, we urge CMS to continue to provide financial support needed to support the ongoing PHE response, as well as the early efforts being made to support post-PHE recovery.

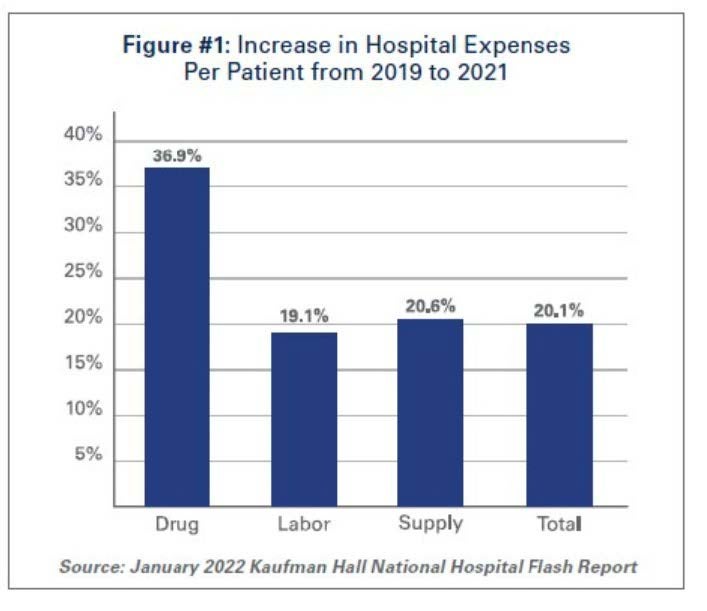

We have specific concerns with the magnitude, methodology and timing of CMS’s proposed parity adjustment, which are described in greater detail below. The proposed payment update is woefully inadequate given feedback from our hospital and hospitalbased SNF members and the findings of recent AHA-commissioned research finding significant cost growth in hospitals. Specifically, an April 2022 report by the AHA highlights the significant growth in hospital expenses for labor, drugs and supplies (as shown in the reproduced chart below), as well as the impact that rising inflation is having on hospital prices.

The report cites Bureau of Labor Statistics data showing that hospital employment levels have decreased by approximately 100,000 from pre-pandemic levels. At the same time, hospital labor expenses per patient through 2021 were 19.1% higher than pre-pandemic levels in 2019. Because labor costs account for more than 50% of hospitals’ total expenses, such increases have very substantial impacts on a hospital’s total expenses and operating margins. As a result of these changes, January 2022 labor expenses per adjusted discharge are 52% higher than the pre-pandemic levels of January 2020. These trends also pertain to HB SNFs, which both use higher levels of registered and other nurses, relative to freestanding SNFs and face the same environmental pressures as their host hospitals. In addition, these trends indirectly affect the recruitment and retention challenges faced by non-hospital healthcare employers in the area, and track with the experience of freestanding nursing homes and SNFs.

While the AHA supports the proposed forecast error correction of 1.5 percentage points, we are deeply concerned that the overall net decrease in SNF payments does not reflect the increased costs hospitals, their HB SNFs and other distinct part units are facing. We urge CMS to discuss in the final rule how the agency will account for these increased costs.

We also are concerned about the proposed 0.4% reduction for productivity and ask CMS in the final rule to further elaborate on the specific productivity gains that are the basis for this proposed market basket offset, as it contradicts our members’ PHE experiences of actual losses in productivity during the pandemic.

Proposed Parity Adjustment for the FY 2020 Implementation of the Patient-driven Payment Methodology (PDPM)

The AHA strongly opposes CMS’s proposed 4.6% parity adjustment, which the agency states is necessary to help ensure the budget-neutral implementation of the PDPM case-mix system, which took effect in FY 2020. The agency estimates the impact of the adjustment would be a cut of approximately $1.7 billion in FY 2023 alone, an overwhelming amount to a provider community still struggling to provide access to care during a PHE. Further, the agency is proposing that the parity adjustment equally apply to all SNFs and all components of the PDPM case-mix system, and be implemented with no delay or phase-in period. Simply put, the SNF field is not equipped to bear the weight of a 4.6% cut given the impact of the PHE combined with the inflationary and other cost increases it is enduring, as described above. The proposal is particularly ill-timed given that CMS is not statutorily required to implement a cut for FY 2023.

In addition, the AHA has a longstanding policy of urging the agency to phase in substantial fluctuations in payment rates in order to promote predictable and reliable payments for the field. As such, if the agency does implement the parity adjustment in the future, we urge it to consider phasing it in, particularly given its current magnitude and likely overwhelming impact on the field.

Proposed Permanent Cap on Wage Index Decreases

In order to mitigate fluctuations in year-to-year wage index changes, CMS proposes a permanent 5.0% cap on any decrease to a provider’s wage index, relative to the prior year, regardless of the circumstances causing the decline. We agree that such a cap would help maintain stability for this payment system, and the others for which CMS also is proposing this cap. As such, while we support this proposed policy, we urge the agency to implement the change in a non-budget-neutral manner. Only then would the proposed cap truly help stabilize hospital finances.

View the complete detailed letter PDF below.